Switzerland: A Magnet for Businesses in 2025

Switzerland remains one of the world’s most attractive business destinations — not just for its political stability, innovation, and skilled workforce, but also for its competitive corporate tax system.

Each canton sets its own tax rates, creating opportunities for companies to choose the best location based on their financial strategy and operational needs.

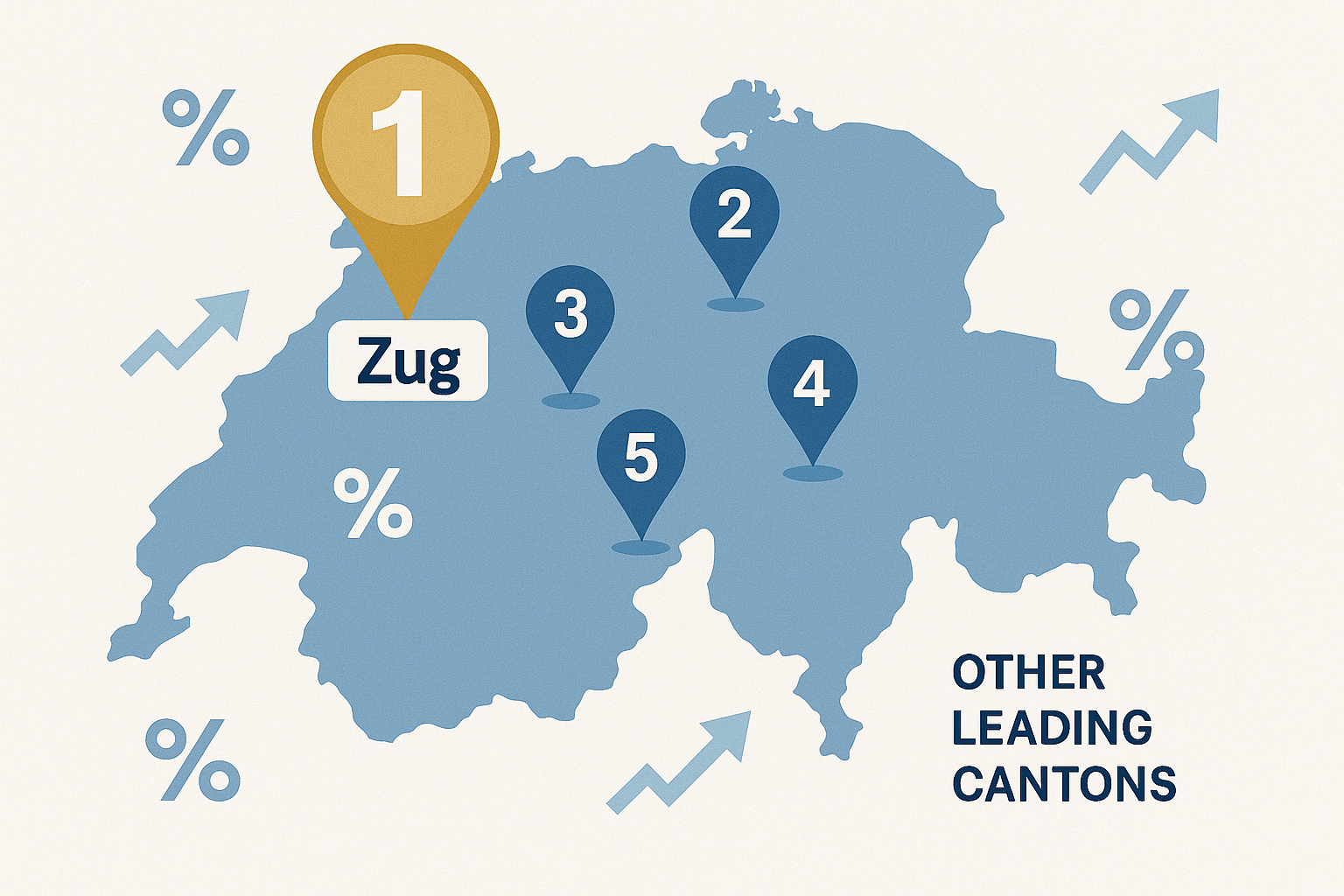

In 2025, five cantons stand out for their exceptionally low corporate tax rates — and Zug continues to be the preferred choice for both local and international entrepreneurs.

1. Canton of Zug – The Gold Standard for Business and Domicile Services

Zug is often referred to as Switzerland’s “Tax Haven Canton”, but it’s far more than that.

With effective corporate tax rates around 11.9%, Zug combines low taxation with a world-class business environment and international credibility.

Why Zug remains unbeatable:

- Low total tax burden (around 11.9%)

- Strategic location near Zurich and Lucerne

- Leading center for finance, technology, and blockchain (“Crypto Valley”)

- Outstanding infrastructure and professional network

- Stable, business-friendly administration

For businesses seeking to establish a presence in Switzerland, a registered domicile in Zug provides not only fiscal benefits but also prestige and trust in the eyes of clients and investors.

👉 Explore our Domicile Services in Zug to secure a prime business address with mail forwarding, company representation, and optional co-working spaces.

2. Canton of Nidwalden

Nidwalden offers one of the most competitive frameworks for international businesses, with effective tax rates around 11.9–12.1%.

It’s especially attractive for intellectual property (IP) management and holding companies, thanks to its patent box and favorable tax deductions.

3. Canton of Lucerne

Lucerne continues to maintain its reputation as a low-tax canton with an effective rate of 12.3%.

Its central location and dynamic economy make it a strong option for companies balancing cost efficiency and accessibility.

4. Canton of Schwyz

With corporate tax rates around 12.4%, Schwyz offers both tax advantages and a high quality of life.

It is a popular choice for trading companies and finance-related firms looking for proximity to Zurich and Zug.

5. Canton of Appenzell Ausserrhoden

Small but competitive, Appenzell AR maintains rates between 12.5–12.7%.

This canton appeals to SMEs and entrepreneurs seeking simplicity and affordable administrative structures.

Zug: The Preferred Location for Domiciled Companies

While other cantons are competitive, Zug remains Switzerland’s benchmark for both tax efficiency and business infrastructure.

RB Swiss Group has been assisting international entrepreneurs and corporations to establish and maintain their domicile in Zug for years — ensuring compliance, prestige, and flexibility.

Our Zug domicile services include:

- Legal business address with mail forwarding

- Representation and local administrative management

- Support with Swiss company formation

- Accounting and annual reporting

- Board member services

- Access to Co-working and meeting spaces

With RB Swiss Group, your Zug-based company benefits from both local presence and global reach.

Conclusion

Switzerland’s corporate tax competition remains a defining advantage for entrepreneurs and global investors.

In 2025, cantons like Nidwalden, Lucerne, Schwyz, and Appenzell AR continue to perform strongly — but Zug stands out as the clear leader for companies seeking a secure, reputable, and fiscally efficient business base.

Start Your Zug Domicile Today

Ready to benefit from Zug’s favorable tax environment?

Our experts at RB Swiss Group can help you establish or relocate your business seamlessly — from company registration to full domicile and accounting support.

📍 RB Swiss Group GmbH

Blegistrasse 7, CH – 6340 Baar

📞 +41 41 410 61 61

✉️ info@rbswiss.com